Information RequiredFor Individual

· 1 Recent Coloured Photograph (3.5 cm X 2.5 cm)

· Proof of identity

· Proof of address

· Name (Full Name)

· Fathers Name

· Date of Birth

· Sex

· Citizenship (whether citizen of India?)

· Residence Address/Office Address,

· Address for communication

· Telephone No. (with STD Code)

· E-mail ID

· Type of Employment (Salaried / Business)

· Type of business / profession

For Company / Trust / Firm / Hindu Undivided Family / Association of Persons / Body of individuals / Local Authority etc. · Proof of address

· Name

· Date of Incorporation (Companies: Date of Incorporation; Association of Persons: Date of Formation/Creation; Association of Person (Trust): Date of Creation or Trust Deed; Partnership Firms: Date of Partnership Deed; and HUFs: Date of creation of HUF)

· Office Address,

· Address for communication

· Telephone No. (with STD Code)

· E-mail ID

Documents Required IndividualFor proof of identity : Copy of school leaving certificate or matriculation certificate or degree of a recognized educational institution or depository account or credit card bank account or water bill or ration card or property tax assessment order or passport or voter identity card or driving license or certificate of identity signed by a Member of Parliament or Member of Legislative assembly or Municipal Councilor or a Gazetted Officers, as the case may be.

For Proof of Address : Copy of electricity bill or telephone bill or depository account or credit card or bank account or ration card or employer certificate or passport or voters identity card or property tax assessment order Legislative Assembly or Municipal Councilor or Gazetted Officer, as the case may be. Incase of a person being a minor, any documents of any of the parents or guardian of such minor shall be deemed to be the proof of identity and address.

HUF (Hindu Undivided Family)

For proof of identity and address : any document prescribed in the case of individuals in respect of Karta of the HUF

Company Copy of Certificate or Registration issued by Registrar of Companies.

Firms Copy of Certificate of Registration issued by the Registrar or Copy of Partnership Deed.

AOP(Trusts)Copy of the Trust deed or Copy of Certificate of Registration Number issued by Charity Commissioners.

AOP/BOI/Local Authority/ Artificial Juridical Person Copy of Agreement or Copy of Certificate or Registration Number issued by Charity Commissioners or Registrar of Co-operative Society or any other Competent Authority or any other document originating from any Central or State Government Department establishing Identity and Address of such person.

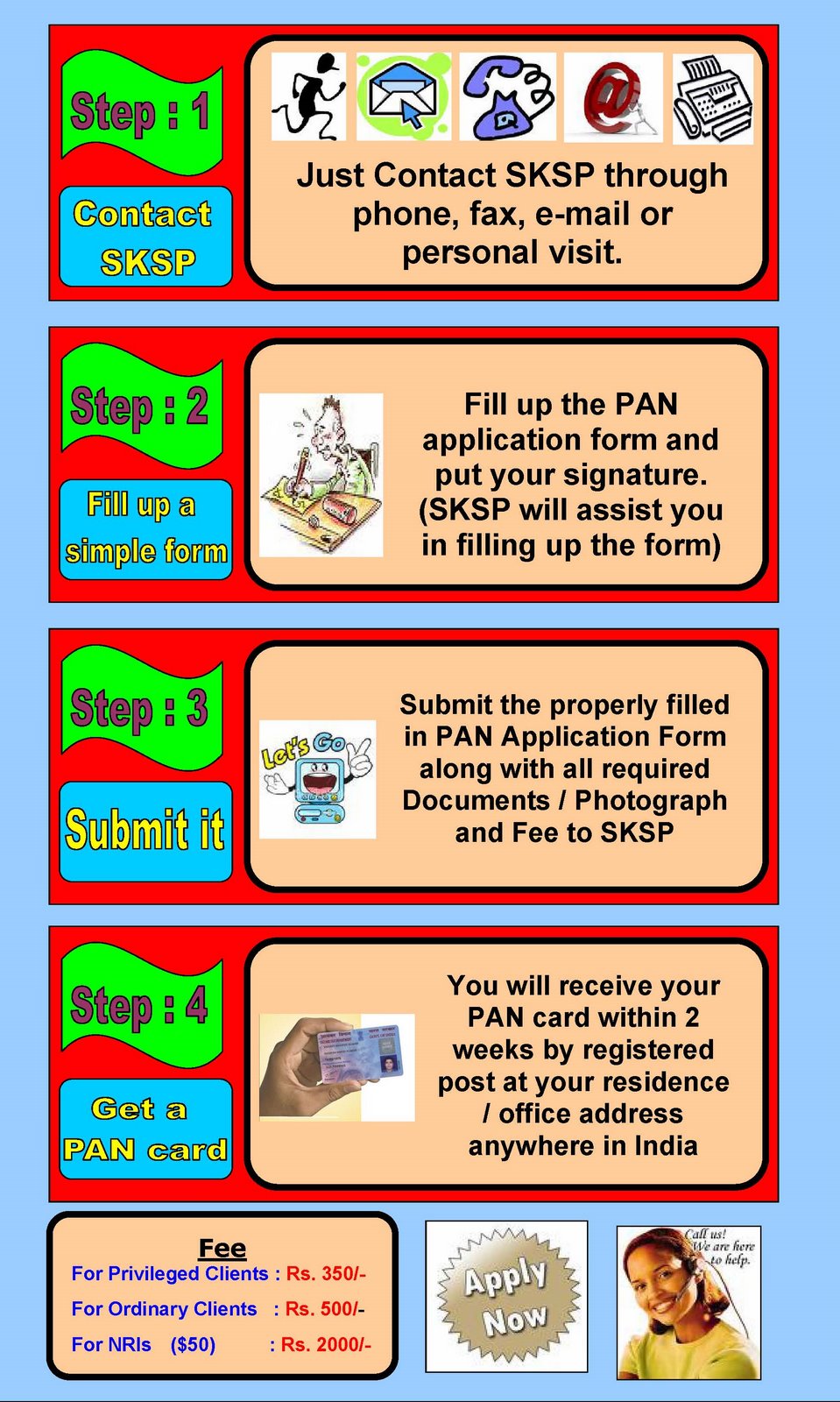

INSTRUCTIONS FOR FILLING FORM 49 A

a) Use BLACK INK for filling the FORM and SIGNATURE.

b) ’Individual’ applicants should paste one recent, coloured photograph (stamp size : 3.5 cms X 2.5 cms).

The photograph should not be stapled or clipped. The clarity of the image on PAN Card will depend on the quality and clarity of photograph pasted

on the form.

c) Thumb impression, if used, should be attested by a Magistrate or a Notary Public or Gazetted Officer, under official seal and stamp.

d) Each box, wherever provided, should contain only one character

(alphabets/number/punctuation sign) leaving a box blank after each word.

e) Area and AO code should be filled by the applicant, in consultation with IT PAN Service Center, if required

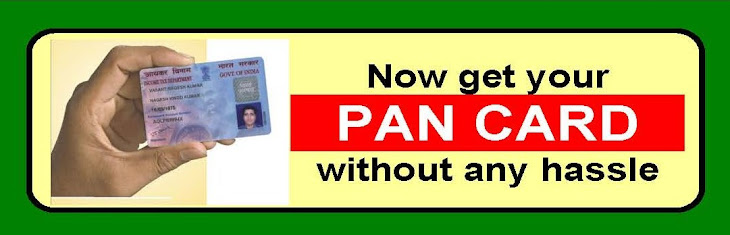

FeeFor

Privileged Clients :

Rs. 350/- For

Ordinary Clients :

Rs. 500/-